Accessibility Tools

PMG Digital Made for Humans

Tech Earnings Deliver Mixed Results, Citing Mounting Cost Pressures, Behavior Shifts

4 MINUTE READ | May 2, 2022

Tech Earnings Deliver Mixed Results, Citing Mounting Cost Pressures, Behavior Shifts

Abby Long

Abby manages PMG's editorial & thought leadership program. As a writer, editor, and marketing communications strategist with nearly a decade of experience, Abby's work in showcasing PMG’s unique expertise through POVs, research reports, and thought leadership regularly informs business strategy and media investments for some of the most iconic brands in the world. Named among the AAF Dallas 32 Under 32, her expertise in advertising, media strategy, and consumer trends has been featured in Ad Age, Business Insider, and Digiday.

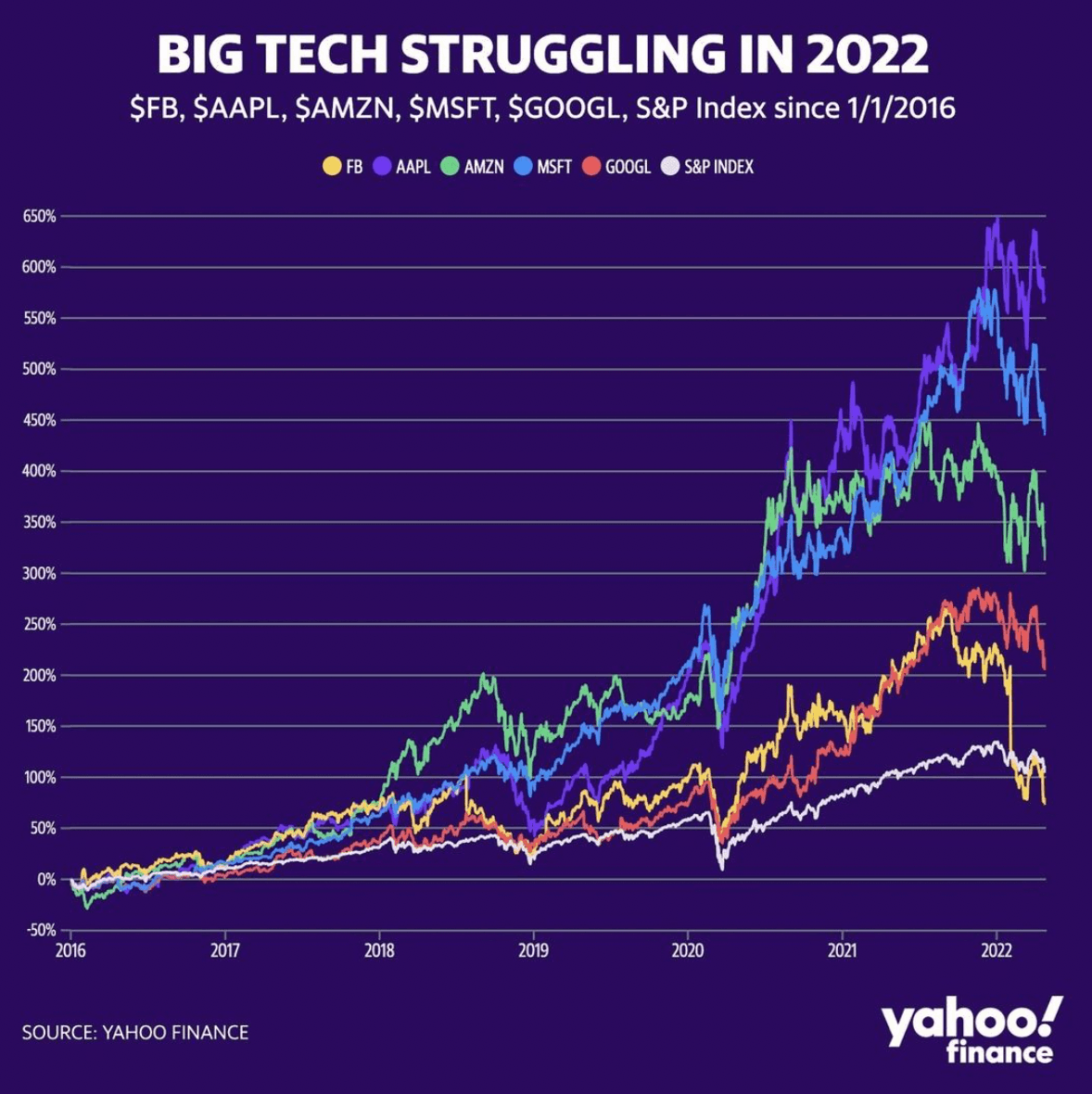

Quarterly financial results across Meta, Amazon, Twitter, Alphabet and Snap stood in sharp contrast to the hypergrowth seen throughout the last two years as global tech giants navigate a sea of new challenges in 2022. Mounting cost pressures, geopolitical tensions in Asia and Eastern Europe, and evolving user behavior were all cited as contributing factors during earnings calls. While many executives shared positive user growth trends, they tempered expectations with lower-than-expected revenue totals for the first quarter.

In the wake of increasing economic uncertainty, total sales across business units at Amazon hit $116.4 billion in the first quarter, a seven percent year-over-year jump. While sales figures landed near the top of the company’s guidance, they fell short of Wall Street expectations of $116.5 billion. According to Barron’s, “Sales for the ecommerce unit fell three percent year-over-year to $51.1 billion, shy of the Wall Street consensus of $51.9 billion… Ad revenue was $7.9 billion, up 23 percent, but well short of analysts’ estimate for $8.2 billion, and down from $9.7 billion in the fourth quarter.” Looking ahead, Amazon anticipates shoppers to adjust their spending habits as cost pressures increase.

As a proof point of market volatility, unfavorable currency exchange rates made a $1.8 billion impact on Amazon’s bottom line, keeping the company from increasing sales by nine percent. In a statement, Amazon CEO Andy Jassy cited ongoing inflationary and supply chain pressures, in addition to the war in Ukraine, as the leading causes of the company’s current fulfillment network challenges and unusual quarterly performance.

In light of the takeover bid by Elon Musk for $44 billion, Twitter withdrew financial outlooks and confirmed the company wouldn't provide forward-looking guidance. Twitter reported promising user growth at 229 million daily active users (a 15.9 percent increase from last year), but just narrowly missed analyst estimates for $1.23 billion in revenue.

Snap cited a “challenging operating environment” as it reported its net loss increased by 25 percent, according to Variety. In a testament to the platform’s popularity among users in North America, Snapchat's average daily active users increased by five percent year-over-year to 98 million, while the European user base grew by ten percent to 84 million. During the call, Snap said a “broad-based slowdown in the rate of ad sales growth during Q1 after Russia’s invasion of Ukraine” was the driving force behind missed revenue expectations. Similar to its competitors, Snap detailed that the ongoing impact of platform policy changes, like Apple’s iOS update, was primarily affecting direct response advertising partners.

Alphabet reported “weaker-than-expected” earnings and revenue growth for the first quarter that fell slightly below expectations, according to CNBC. Alphabet's revenue was $68.01 billion, increasing by 23 percent from the previous year. Google’s advertising business unit accounted for 58 percent of Alphabet’s revenue, totaling $54.7 billion, up 22 percent from $44.7 billion in the first quarter of last year.

Related: Microsoft search and ad revenues rose an impressive 23 percent to $544 million as search and gaming advertising opportunities with the company increased.

A strong performance was seen across Google Search and Google Network, with revenues reaching $39.6 billion and $8.2 billion, respectively. However, YouTube advertising revenue fell short of estimates, coming in at $6.9 billion, over a billion dollars less than expected. Insider Intelligence hypothesized that “slowing YouTube ad growth appears to correlate with increasing TikTok advertising growth.” In contrast, Alphabet executives said the “modest growth” in YouTube advertising was mostly in direct response ads, with the larger deceleration reflecting “tough year-over-year comparisons to a strong first quarter in 2021.”

Interestingly, YouTube’s TikTok competitor Shorts now clocks 30 billion daily views, double the number of views recorded in the previous quarter, and a 4X year-over-year increase. The company confirmed two ad types are being tested on Shorts: app install and video action campaigns, and Alphabet is “encouraged by initial advertiser feedback and results.”

Facebook parent company Meta posted mixed results for the first quarter, as profits reached $7.5 billion (down 21 percent year-over-year) and revenue increased seven percent to $27.9 billion. The totals represented the slowest growth rate for the company in nearly a decade. The hefty long-term investments required for Meta’s pivot from social media to the metaverse are making a dent in the company’s financials as first-quarter spending on Reality Labs, Meta’s AR and VR division, totaled $3.7 billion with only $700 million in revenue. According to Fortune, the resulting operating loss puts Reality Labs on track to lose $12 billion in 2022, up from $10.2 billion in 2021.

Elsewhere, Facebook's daily active users (DAUs) in Q1 2022 rose four percent year-over-year to an average of 1.96 billion users in March, a slight increase from the prior quarter’s 1.93 billion, which was its first-ever drop in daily users. The DAU increases are a positive signal for Meta; however, analysts note that Facebook isn’t out of the woods yet and is still struggling to bring in new users. According to Insider Intelligence, a significant part of DAU growth last quarter originated from markets outside North America, which bring in less ad revenue per user. Daily users across Instagram, Facebook, and WhatsApp now total 2.87 billion globally, though Meta expects a “sequential decline” in Facebook's monthly average users after the platform was removed from the Russian market last month.

Meta is clearly still growing though the growth rate is a significant change of pace and a shift largely driven by a host of challenges, including the rise of TikTok and proliferation of short-form video, long-term web3 investments, regulatory scrutiny, privacy updates, and user behavior changes. In a bright spot for Meta, time spent on Instagram Reels accounts for 20 percent of all time spent on Instagram, as the popularity of short-form video formats continues to drive advertiser interest and user engagement. In light of these financial trends, Meta Founder and CEO Mark Zuckerberg shared the company will “slow the pace” of some investments in the months to come.

Stay in touch

Bringing news to you

Subscribe to our newsletter

By clicking and subscribing, you agree to our Terms of Service and Privacy Policy

“It’s important to note that headlines around earnings reports aren’t able to tell the full story behind many of the trends driving these platforms forward. We continue to see strong performance across Facebook and Instagram as brands navigate privacy changes and shifting consumer trends,” said Carly Carson, head of social at PMG. “Looking ahead, we’re most interested in the continued push toward short-form video and contextually-driven shoppable commerce advertising opportunities across platforms. As TikTok continues to expand its video length beyond 60 seconds in contrast to shorter mediums on rivals Instagram Reels and YouTube Shorts, it will be interesting to see if users gravitate back towards more short-form content or if people remain engaged for longer periods of time.”