Accessibility Tools

PMG Digital Made for Humans

Retail Brands Won More SERP Real Estate, But Likely Fewer Clicks in Google's August Core Update

6 MINUTE READ | October 25, 2023

Retail Brands Won More SERP Real Estate, But Likely Fewer Clicks in Google's August Core Update

Sam Callender, SEO Strategy Director, PMG

Sam Callender leads PMG's performance content practice, working across the SEO team to level up organic search and content strategies for clients across PMG's entire portfolio. With over 15 years in roles spanning FedEx, Amazon, and R/GA, Sam relies on his deep industry experience and technical expertise across digital and product marketing to support B2B, tech, ecommerce, and retail brands.

Jonathan Hunt, SEO Supervisor

Jonathan Hunt has been with PMG since 2013 and is a senior leader on the SEO team, guiding automation and technology strategy for organic search. His 17 years of experience in SEO has included leading programs for ecommerce, technology, entertainment, and b2b brands. Jonathan was recently named a finalist for AAF Austin’s 2023 Big Wigs Awards for Best Data Analyst.

As Google search engine results pages (SERPs) have transformed with new content features, they've presented performance headwinds for many retailers. PMG’s analysis shows that while retail brands experienced increased visibility on SERPs coming out of Google’s August 2023 Core Update, brands may not have experienced increased traffic as a result.

In this article, we explore,

Key takeaways from our analysis on the retail brand impact of Google's August 2023 Core Update

Our research methodology & considerations

A closer look at SERP Features growth and Local Pack Listings declines

Our recommendations for SEOs and retailers moving forward

So far in 2023, we’ve already seen increases in Google Shopping placements, the addition of Popular Products, and dramatic changes to the layout of branded SERPs, putting a renewed focus on defending your brand in organic search. The introduction of generative AI tools for creating long-form and image-heavy content adds another element to the chaotic mix of change facing retail brands and their SEO teams.

Add to all this the coming integration of Google Search Generative Experience for Search (SGE), which promises to turn traditional search behavior on its head and could completely reinvent how users discover products online. In many ways, the impact and trends we’re seeing in the August Core Update could be seen as paving the way for the SGE transformation. The August Core Update has been followed quickly by the Helpful Content Update and another October Core Algorithm Update.

Google’s August Core Search Algorithm update launched just five months after the previous core update in March 2023. Several other recent updates have also impacted retailers, including the February 2023 Product Reviews Update and the December 2023 Helpful Content Update. While further analyses of the recent core update have provided great insight into the broad impact of this update on thousands of sites, we’ve decided to look specifically at the impact on 56 U.S. DTC retail brand sites, many of which are household names and PMG retail customers.

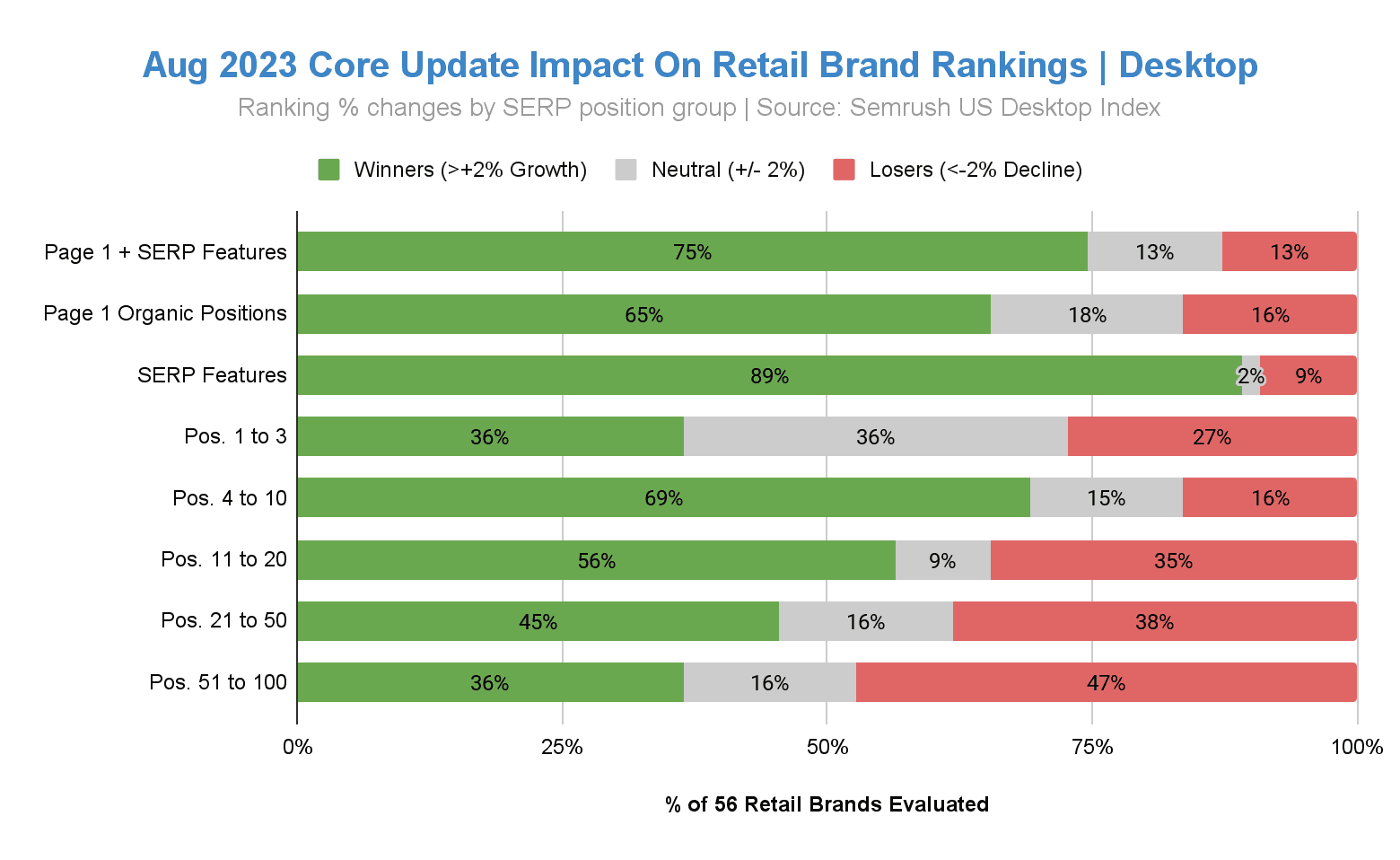

Retail brands grew in Page 1 visibility. Overall, the retail brands we measured saw an increase in organic search visibility, with 37 of 56 sites experiencing an improvement in positions 1-10, and 40 websites either grew or maintained in the top three positions. Sixty-five percent of brands showed improvement in their top ten positions. Page 1 growth came entirely below the fold, while 74% of brands were flat in positions 1-3 on Desktop.

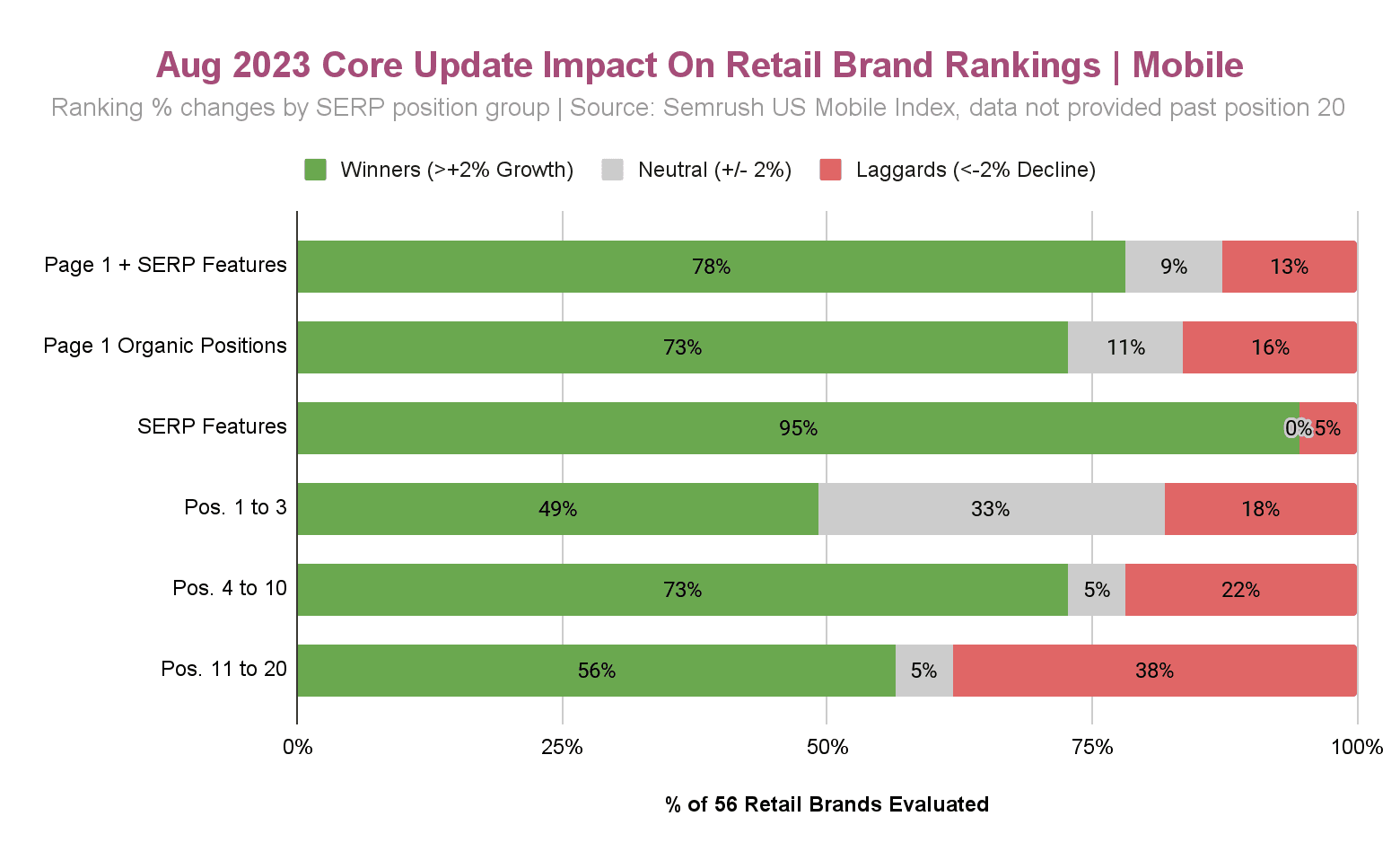

Mobile visibility grew more than desktop in all rank zones. Overall, mobile and desktop trends were largely similar, though mobile results tended to be a bit stronger in both directions, with more winners and higher growth peaks for those seeing a positive impact to their rankings from this core update. Retail brands grew Page 1 visibility across devices, but more on Mobile, as winners included 37 brands on Desktop and 41 on Mobile.

Retailers are showing up more in SERP features than in regular organic results. Increased SERP feature rankings drove overall visibility growth, with all but six brands experiencing an improvement. The People Also Asked feature drove this growth while offsetting Local Pack losses.

Retail brand sites may find it harder to compete for non-brand searches. Moving further down the SERP (positions 20-100), most brands experienced steeper losses, with 47% negatively impacted after position 50. We broadly interpret this as Google fine-tuning relevance for retail brand sites, which likely affects non-brand terms. The top 3 positions were majority positive and flat for 41 brands on Desktop and 46 brands on Mobile, suggesting that most retail sites maintained visibility with their primary traffic-driving search terms.

For our analysis, we gathered Semrush rank distribution data for 56 consumer retail brands in the United States ten days before and ten days after the August 2023 core update.

We specifically focused on the impact of the core update on consumer retail brand sites, and not the broader ecommerce and retail industry (e.g., department stores, ecommerce giants, resellers, second-hand markets, etc.). This allowed us to concentrate on the impact on retail brands selling direct to consumers through their own websites, many of which face similar challenges in organic search based on the architecture of their sites and target audience search behavior.

Our list of 56 brands was selected based on our customers, their industry competitive set, and some additional sites that were hand-picked based on retail industry intelligence and good old-fashioned shopping mall directories. Eighty-six percent of these brands are household names in Fashion and Apparel, with the remaining 14% in the Home, Tech, and Health and Beauty categories.

To measure the impact of the August Core Update, we gathered aggregate rank distribution data from Semrush using the default keyword rank segments (Positions: 1-3, 4-10, 11-20, 21-50, 51-100, and SERP Features). We compared the total count of keywords indexed and counts within segments for each brand ten days before (August 12 to 21) and ten days after (September 8 to 17) the August Core Update rolled out. This allowed us to broadly compare changes in rankings and indexation between brand sites with varying degrees of brand search interest, product assortment, and customer type.

Our analysis employed one method of measuring visibility based on rank distribution and indexation. This does not consider the search volumes or individual keywords within the distribution to assess the share of voice (or similar metrics) that are helpful in more deeply understanding the impact on a particular site. We chose to focus on rank distribution because it allows us to observe patterns in how the SERP may be changing for retail brands, and it better supports a more comparable comparison between brands with different search behavior and demand associated with their products (e.g., Gucci versus Gap).

Visibility is often used as a proxy for organic traffic, but they are different, and visibility should not be used to measure traffic impact. There are many individual factors we cannot account for that impact both visibility and organic search traffic, such as website content changes, sales and promotions, technical site issues, and consumer behavior, to name a few.

The 56 retail sites evaluated were grouped into performance tiers based on the percent change from the “pre” period to the “post” period of the August 2023 core algorithm update. Retail brands showing a plus or minus 2% change in keywords from the pre- to post-period were grouped as winners and laggards, respectively. The charts below summarize how these 56 retail brands performed from the top to the bottom of the SERP by position group.

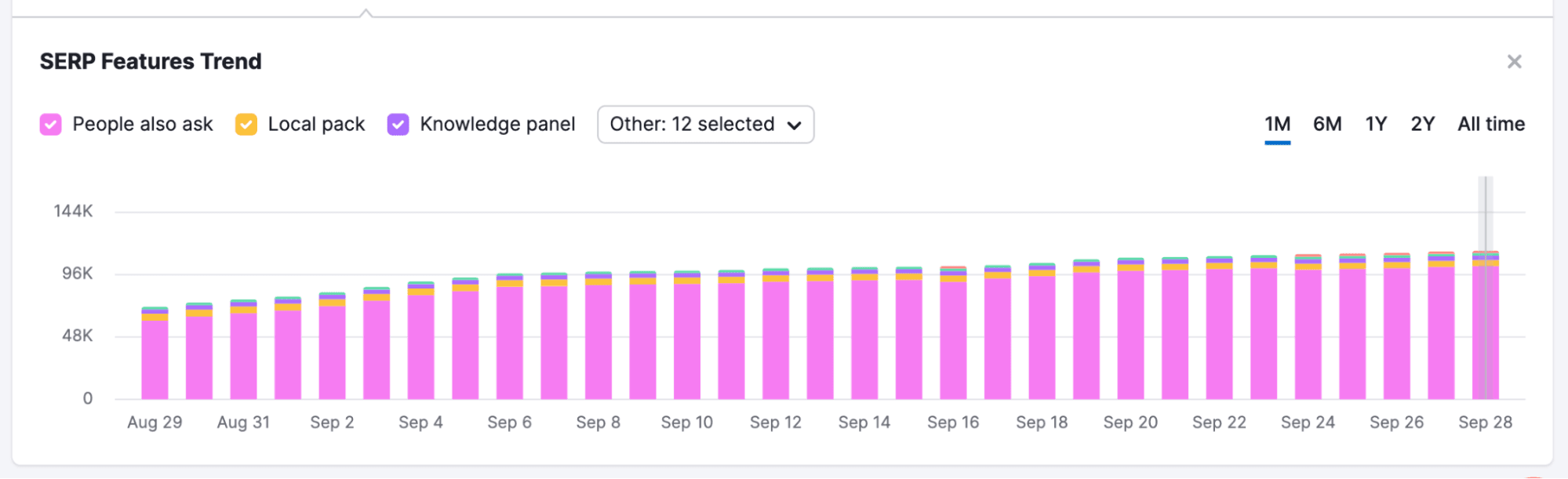

As mentioned, the area with the most growth across retail was via SERP Features. Of the 56 brands we monitored, 50 (89%) experienced greater than 2% growth in the number of keywords where they appeared in a SERP Feature result. Only five (9%) saw declines in their results over the same period.

Semrush identifies at least 40 different formats of SERP Features, including Knowledge Graphs, Sitelinks, and Image Carousels, to name a few. Our methodology did not allow SERP Feature-specific tracking during our data pulls. However, we were able to manually check a handful of brands to try and identify trends in behavior.

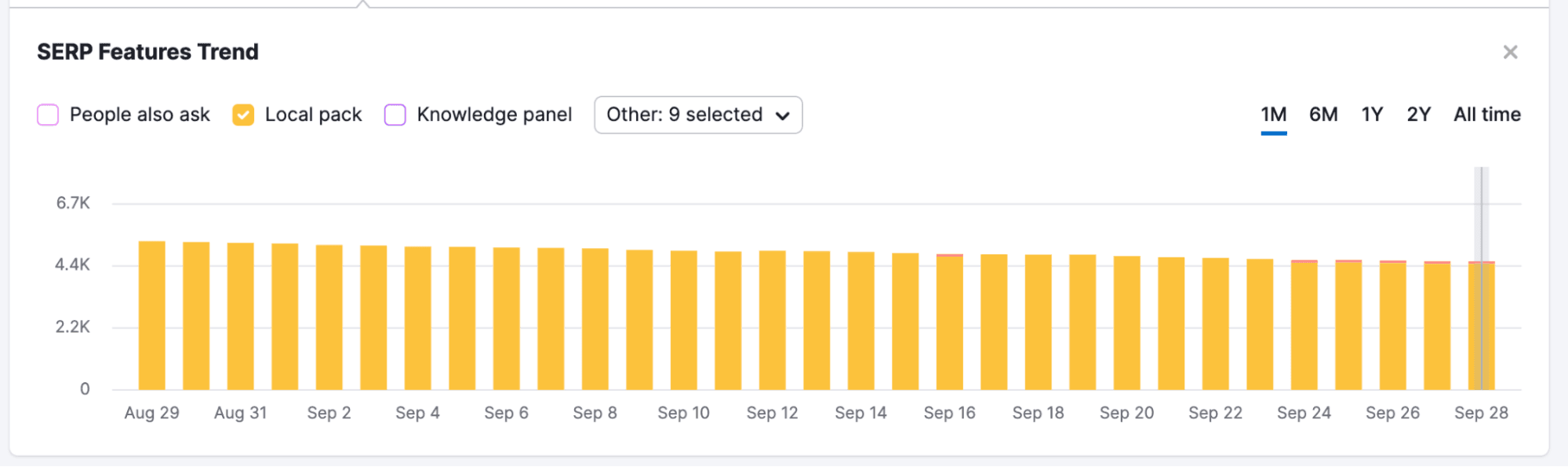

Across the board, every brand included in our analysis witnessed growth in SERP Features from a staggering surge in the frequency of People Also Ask placements. At the same time, all brands in our set also witnessed declines in Local Pack listings. PMG found that a brand being labeled a "winner" versus a "loser" in the SERP Features segment often depended on how the brand’s People Also Ask and Local Pack split was before the August 2023 Core update.

For example, one major retailer—and one of our big winners in this update—lost nearly 1.2K Local Pack placements between August 29 and September 28. This rate of decline (~20%) was common across the brands we manually reviewed. Still, the loss of 1.2K Local placements is nothing compared to the additional 45K placements from People Also Ask listings they gained over the same period.

Mobile results for SERP Features are even more one-sided, with 94.6% of all brands growing more than 2% from pre-rollout averages. Only three of the 56 brands showed more than a 5.4% decline: Cole Haan (-19%), Belk (-23%), and Club Monaco (-35%). Again, this shift on Mobile was driven by increases in People Also Ask placements. Local Pack results look to have remained relatively high on Mobile, resulting in a larger percentage of brands showing gains of 2% or greater during the rollout.

As we mentioned at the beginning of this analysis, the August Core update was immediately followed by a Helpful Content update and an in-progress October Core update. Based on the analysis of other SEO experts, the Helpful Content Update was less relevant to brand retail brand sites than content-focused sites, such as blogs and publishers. While the dust still has yet to settle for all three of these back-to-back Google algorithm updates, retail brands should consider the following for 2024 planning in light of these changes:

Invest in your retail content experience. As the layout of the SERP continues to shift towards more prominent SERP Features, brands will need to optimize their content to compete in these spaces. This will become even more important when Google rolls out AI-generated results in the SERP. The core pages on retail sites (product pages, categorical pages, shop grids, and location pages) should have robust content strategies to influence SERP features and AI-generated content about their products.

Adjust your 2024 KPIs to focus on both traffic and visibility. A more visual SERP will likely result in less traffic, even for sites that maintain rankings. As part of 2024 planning, marketers should take steps to establish their current organic share of voice and rank distribution, setting goals to either protect or grow visibility in specific segments of search behavior.

You can no longer assume you’ll maintain visibility in brand terms. Over the past year, we have observed significant changes in the SERP, increasing competition between retail brands and other sites selling their merchandise. The increasing prominence of Popular Products and other features give customers more choice on the SERP, even when searching for a trademark style. When forecasting, remember that your 2023 baseline may not translate to 2024.

Stay on top of technical best practices. Crawling and indexing, regionalization, page experience (Core Web Vitals), structured data markup, and properly managed product feeds are still table stakes. Get your house in order because the major ecommerce sites that are selling your products have invested heavily in these areas. The work is never finished here.

Stay in touch

Bringing news to you

Subscribe to our newsletter

By clicking and subscribing, you agree to our Terms of Service and Privacy Policy

Stay tuned as we continue to monitor Google's many recent changes and their impact on retail brand sites.